According to IHS iSuppli's power management analysis report, all areas of the power management semiconductor market have grown in 2010, the overall industry has expanded to 31 billion U.S. dollars, and individual fields such as voltage regulators and specific transistors have even increased by as much as 40%. the above.

According to IHS iSuppli's power management analysis report, all areas of the power management semiconductor market have grown in 2010, the overall industry has expanded to 31 billion U.S. dollars, and individual fields such as voltage regulators and specific transistors have even increased by as much as 40%. the above.

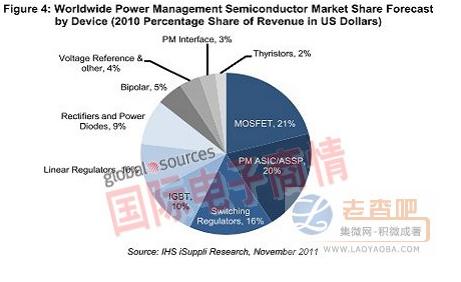

Last year, the largest area in the power management semiconductor market was MOSFETs for converting electronic signals, which accounted for 21%. This is followed by application-specific integrated circuits and proprietary standard products related to power management, which account for 20%. Switching regulators ranked third, accounting for 16% of the share, linear regulators and insulated gate bipolar transistors (IGBT) each accounted for 10%.

Other areas of the market are rectifiers and power diodes, bipolar transistors, voltage reference devices, power management interfaces, and thyristors, each with a share of less than 10%, as shown. The total power management semiconductor market was 31 billion U.S. dollars, an increase of 41% over the previous year.

The theme for 2010 is "capacity." Due to the high demand in the previous year, those who mastered a large amount of production capacity, especially key players in the market, ultimately achieved the greatest success. IHS believes that quantity is a ticket to production, and it is also a ladder to a leading market ranking. Power Management The semiconductor market consists of products that are specifically designed for power conversion, distribution, and management in electronic systems.

The growth of IGBTs in 2010 was outstanding, with a sharp increase of 56%, from $1.9 billion in 2009 to $3 billion. The growth was mainly due to China's improvement of infrastructure, the development of environmentally friendly energy sources such as solar and wind power, and hybrid and electric vehicles.

In terms of vendor rankings, Texas Instruments maintained its top position. Its revenue growth was mainly driven by organic growth, such as the addition of LED drivers and ultralow power voltage regulator ICs for portable applications. In 2010, Texas Instruments’ power management revenue reached US$2.5 billion, an increase of 46% over the previous year.

In 2010, there were two new faces among the top 10 manufacturers, namely the International Rectifier Corporation of the United States and Renesas Electronics of Japan. After three years of absence, International Rectifier Corporation once again entered the top 10 rankings, but in 2010 the company's organic growth rate was the highest, reaching 58%, far higher than the industry average of 41%. Renesas Electronics succeeded in its acquisition of Japan’s NEC’s semiconductor division.

In 2010, the total market share of the 20 largest suppliers rose from 67% in 2009 to 70%. The market share of North American suppliers has increased from 41% to 42%, and the limelight has overtaken Asian peers. This is the first time in six years. It is not easy.

Power management semiconductor suppliers are currently trying to significantly adjust their focus from producing consumer semiconductors to high-value devices. By improving product structure, suppliers hope to increase their ability to adapt to fluctuations in demand and industrial economic transfer.

However, IHS believes that this strategy must be carefully considered, especially because the high-value market for power management semiconductors is much smaller than that of consumer devices. In addition, the market will become very crowded as the manufacturers adopt the same strategy.